Many a politician has described budgets as not just being a collection of numbers on a page, but rather an expression of the

government’s values, principles and aspirations. In fact, this year’s Victorian Budget papers are emblazoned with the motto “Focused On What Matters Most” so it is a telling and insightful reflection of this government’s priorities. And spoiler alert – it is clearly not volunteers,

fire services or CFA that matters the most.

Despite documenting a record tax hike under its new Emergency Services Tax, less of that money is making its way to CFA than ever before.

The budget papers reveal the new tax will collect $1.6 billion dollars this year. This is the highest tax haul ever in the entire history of the preceding Fire Services Property Levy. So, with this record tax haul –

surely CFA must be receiving a record-breaking budget? And if it were, government MPs would be very excited to tell everyone about it right?

So, what did this year’s Parliamentary Public Accounts and Estimates Committee (PAEC) inquiry into the 2025-26 budget estimates reveal over its two weeks of testimony from accountable Ministers?

If “I love you” are the three hardest words in the English language according to Hollywood and boybands, then “The CFA budget is….” must be the four hardest words for a Victorian MP to utter.

Despite hours and hours of testimony, neither the Premier, Treasurer nor Minister for Emergency Services were able to answer a very simple question - what is CFA’s base budget this year? Each handballed to the other, with the Premier’s testimony in particular - a sickening example of meaningless rhetoric

dressed up as compassion and empathy that ultimately ignores the very people they claim to support.

The hearings confirmed that it will cost $12M a year to administer the new tax. That’s code for bureaucrats – and is $2M more than what they committed to add to the CFA budget for fleet.

Only in Victoria would spending on bureaucracy be more important than fire trucks.

Their non-response on the CFA budget is inconsequential however, as it is actually quite easy to calculate. If anything – their refusal to confirm what can already be calculated is a clear sign they find

themselves on shaky ground.

First, let’s look at the legislation itself. Section 12(d) of the applicable Act states that in the case of levy rates for each year subsequent to the 2024-2025 levy year – “(2B) The percentage of the annual funding requirements of the CFA and VicSES that are to be funded by the levy in a levy year is 95%.”

Then we move to Section 12(5A) which stipulates that the Minister must publish the amount in dollars forecast for each funding recipient.

This was done through Government Gazette, dated 30 May 2025, that confirmed that 95% of CFA’s forecast annual funding requirements for the upcoming year 2025/26 was $312,004,751.

This makes it very easy to calculate that 100% of the forecast funding requirements for CFA is: $328,426,053.68 or in other words - $328 million. So now we compare this figure against the figure that the Treasurer tabled in PAEC last year for CFA’s forecast budget for 2024/25 – which was $337.6 million.

You don’t have to be Einstein to figure out then that this year’s number is about $9 million less than the year

before. That’s the sixth year in a row.

Now when you heard the Government spruiking its new Emergency Services Tax and how our emergency services and volunteers were working harder than ever and needing much more support to justify the huge tax increases being imposed on property owners,

where in that did you see them admit they were increasing the taxes they were collecting but would actually be giving less money to Victoria’s largest volunteer emergency service whom they labelled their tax after? The extra money collected is now being diverted to Government departments and public sector employees, making a mockery that this new tax would be supporting Victoria’s front line emergency services. Don’t take my word for it, refer to the Government Gazette which now shows that only $1.1 billion of the $1.6 billion taxes collected are actually going to CFA, FRV and SES. The other $500M is now being sent to departments that used to already be funded under consolidated revenue which is not only $500M in new revenue, but an extra $500M they are

no longer spending from consolidated revenue.

So, what would a real investment in CFA look like? Well – it would cost $515M to replace every single CFA truck in

the fleet that is older than 20 years – even if you could do it all at once in a single year. How much did they actually commit from their record tax haul in extra funding? - $10M. That is not a typo. That’s just three fifths of one cent for every dollar collected.

Don’t fall for the $40M figure they bandy about – that is

$10M over four years. Don’t fall for the $70M “rolling fleet” they bandy about. That’s the $10M a year for CFA (40), and $7.5M for SES over four years (30). And don’t fall for the $110M “rolling truck” figure they bandy about. That’s just the $70M over four years for CFA and SES plus the new $10M for FRV over four years. (40) Talk about how many ways can you spin a single depressingly tiny figure.

This is the reality of the new emergency services tax. Gouging the eyes out of Victorian property owners without actually addressing the fundamental issues of Victoria’s creaking old fire truck fleet.

So, if that won’t move the needle on this much

needed investment what will it actually take? I shudder to think it will only take a fatality or serious injury when an old truck fails on the fire ground to spark action.

We must continue to call out the brazen spin and mischievous untruths that continue to pull the wool over the eyes of Victorians and how badly its fire

service budgets are being managed. While the $10M investment is progress, VFBV will be redoubling its efforts to educate on the ageing CFA truck fleet and the looming catastrophe of a decade of fleet and budget mismanagement.

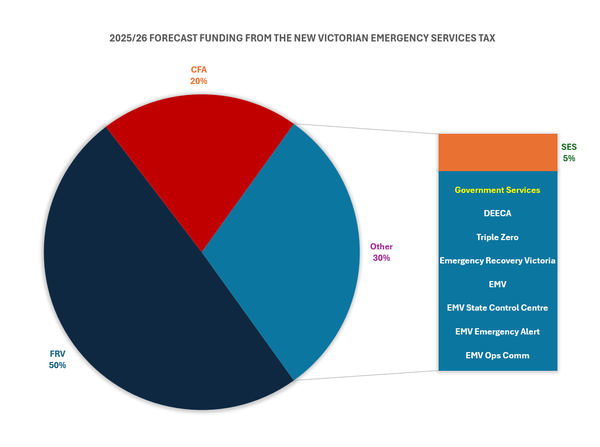

I have also recently reiterated VFBV’s support for the actions taken by the Municipal Association of

Victoria in its opposition to the new tax. We have requested that councils show a pie chart on rates notices that clearly shows taxpayers how much of their emergency service tax is actually going to each emergency service. This will show how little is going to frontline services. Our analysis confirms that just 20% of the total revenue collected from this new tax will go towards CFA. 50% will go towards FRV. The remaining 30% is now being redirected away from the fire services – and will now

fund other government entities.